Today Intel announced its Q1 2022 results. We do not regularly cover earnings announcements, but this seemed like an opportunity to do so. Specifically, we wanted to focus on a few key announcements during the earnings presentation and deck since they give some insights into the next year.

Intel Earnings Q1 2022 Notes

On the overall notes, Intel said that it is on track, possibly ahead in delivering new manufacturing nodes. This is perhaps Intel’s biggest weapon in going after competitors using TSMC. We also see that Sapphire Rapids is “shipping initial SKUs” but we do not expect the formal launch until very late in Q3/Q4-ish so do not get too excited about that.

In terms of financial performance, this was not good. Intel said this was per the communicated plan, but down 1% year/year is much larger viewed through the lens of 7%+ inflation.

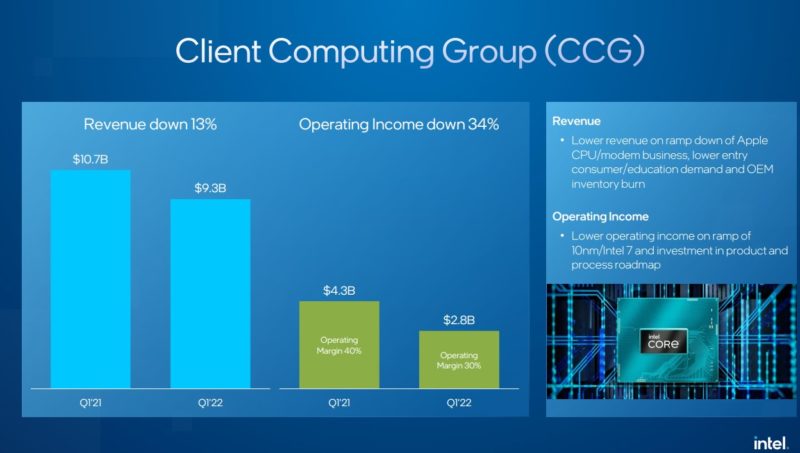

Client Computing Group lost its leader recently as Gregory Bryant went to NXP, but the performance of CCG was poor. Let us just call it how it is.

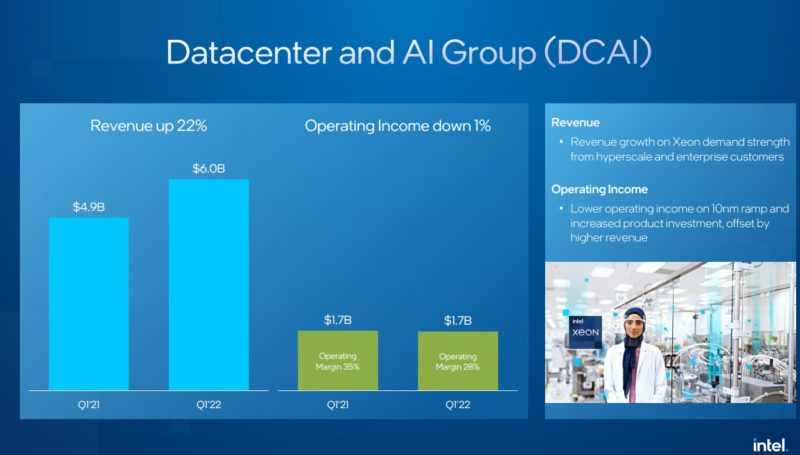

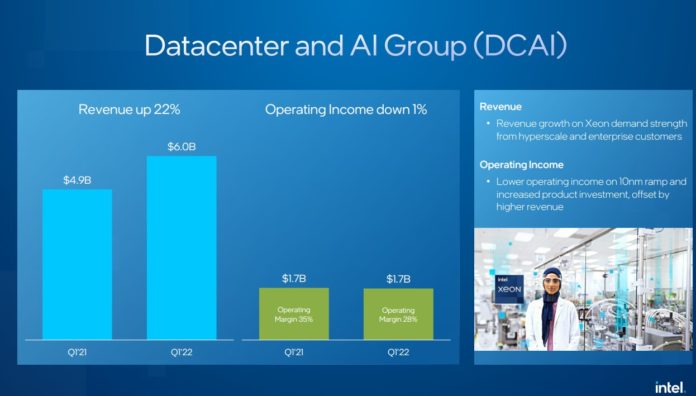

The Datacenter and AI Group, now DCAI, had an interesting quarter. Revenue was up by a fairly massive amount, 22%. That is without a new generation of server CPUs. The operating income was down slightly. That means DCAI saw much lower margin. Intel mentioned at one point during the call transitioning capacity to get Meta more chips. It also said that this was due to a ramp in Ice Lake. Generally, hyper-scale customers are much lower margin so it is interesting that Intel swapped capacity to a hyper-scale customer if it had the opportunity to sell chips elsewhere unless it was required to keep the relationship. Intel also mentioned challenges like the lack of Ethernet adapters gating server deliveries. Usually, server adapters are not built on the latest process nodes, so that is not a 10nm part.

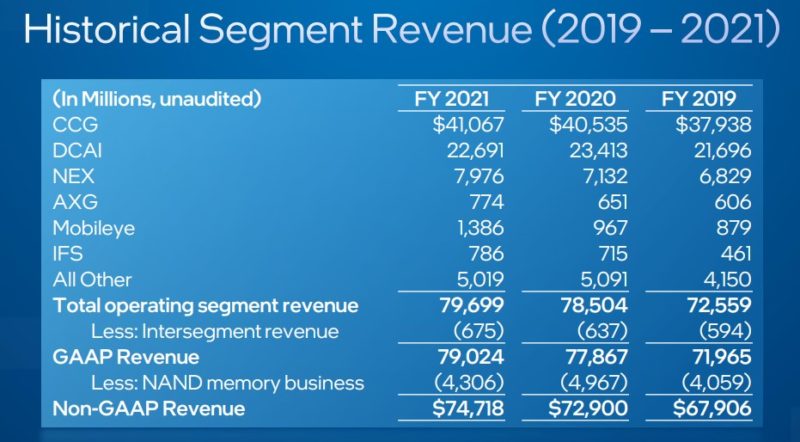

Intel shared another view of this. Here is revenue growing slightly from 2019 to 2021 (again these are not inflation-adjusted.)

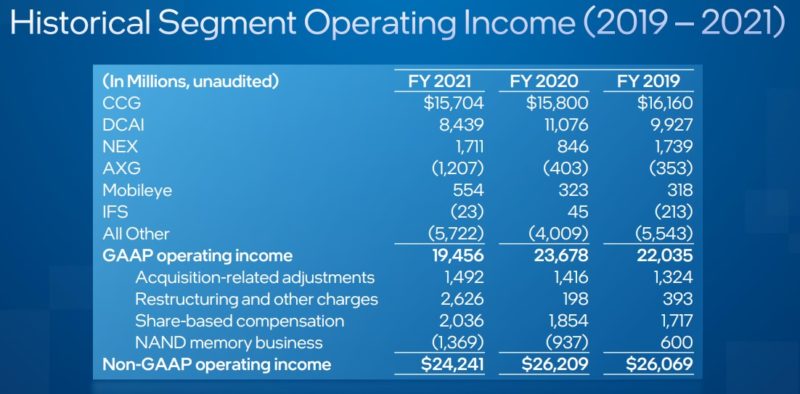

Even with that, the DCAI operating income has fallen. AMD EPYC 7002 “Rome” arrived in the market in 2019 for some perspective.

Another note here is that Intel said that Guadi 2 is now sampling, that is Intel’s AI training chip from the Habana Labs acquisition. Intel also said that it was expecting more Ice Lake ramp into 2022.

That is actually important. It seems like Intel is positioning Ice Lake Xeons to take the lower-end segments of the market where Cascade Lake is still selling as Sapphire Rapids moves to the high-end. Intel also said Sierra Forrest is on track and that it makes sense to have cloud and high-performance architectures.

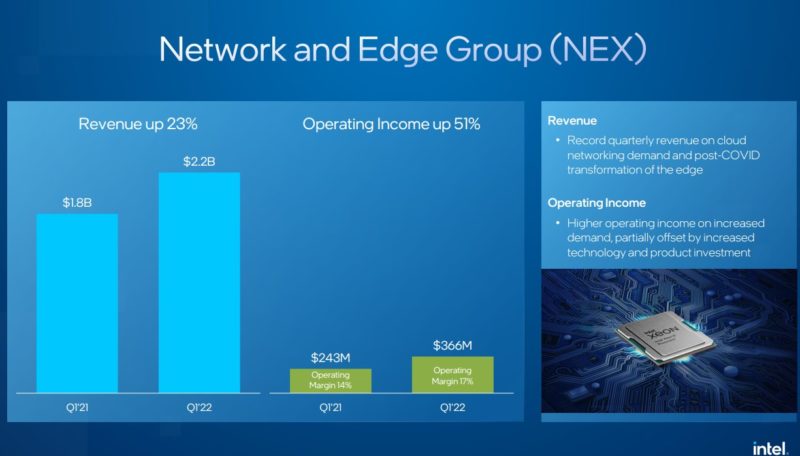

The Network and Edge Group revenue in earlier years would have been buried in a datacenter number. However, Intel is pulling this area out since it is an area for growth.

The new Intel Xeon D-2700 and D-1700 codenamed “Ice Lake D ” is a big driver here. Companies like Cisco and Juniper have projects with the new chip.

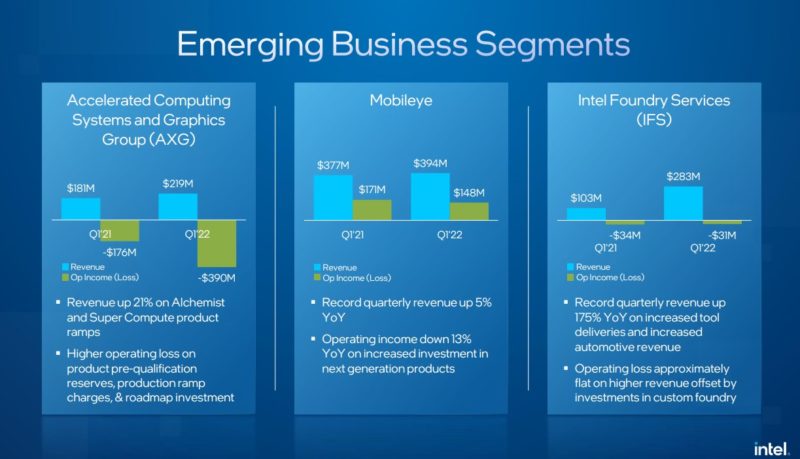

Intel Accelerated Computing Systems and Graphics (AXG) is losing money, but growing. It started shipping its new mobile Arc GPUs in early Q1 but this did not lead to a huge revenue increase. Ponte Vecchio is sampling along with Sapphire Rapids is sampling. Arctic Sound will be available in the second half of the year. STH will be working with this when we can get the card. AXG is another $1B+ business this year for Intel. It is also losing quite a bit of money at this point because Intel is entering a new market.

IFS is progressing with the Tower Semiconductor acquisition and is at a $1B/ year run rate. Mobileye is progressing towards an IPO later this year.

Final Words

To me, the biggest takeaway was really the Ice Lake ramp into 2022. While Intel needs Sapphire Rapids at the high-end, there is a bifurcation happening in the server market. Instead of the entire market shifting with a new generation of processors, as would happen with Xeon E5-2600 V3 to V4 for example, we now have the previous generation processors serving as a lower-cost platform due to the older PCIe generation and memory needs keeping platform costs lower. By the end of 2022, Ice Lake will certainly not be anywhere near the performance of the top-bin Intel and AMD CPUs. Between that insight and the Sierra Forrest coming, it seems like Intel is embracing the idea of servicing different market segments with different CPUs and generations for the foreseeable future. This is a big shift from what we saw Intel do 5-6 years ago.

My general sense is that Intel needs another generation of products or two and to keep executing on the manufacturing process to turn around the current headwinds it is facing.

“Intel needs another generation of products or two and to keep executing on the manufacturing process to turn around the current headwinds..”

What will be competition for SPR-HBM? Intel’s slides showing it outperforming SPR by around 2x of OpenFOAM CFD benchmark.