This is one of the more interesting acquisitions we have seen in years. Broadcom (formerly, and trading under the ticker symbol for Avago that purchased Broadcom) is traditionally a hardware player that is going to become a big software player overnight. This is part of the company’s shift to enterprise software after purchasing CA Technologies. It also follows a fairly predictable plan for the company’s leadership.

Broadcom Agrees to Purchase VMware

While the company is now Broadcom, it was previously Avago. Many longtime readers know that we have chronicled the business practices of Broadcom/ Avago for some time, even back to 2016 in the Business side of PLX acquisition: Impediment to NVMe everywhere. After Broadcom’s failed Qualcomm bid in 2018 due to anti-trust concerns, the company pivoted to add enterprise software. The company purchased CA Technologies and Symantec’s enterprise security business now building a software unit that VMware will fit into.

Many in the hardware industry that we cover know Broadcom-Avago’s game plan. They purchase companies like PLX that makes PCIe switches. These are usually the best components in markets with few if any competitors (Microchip is probably Broadcom’s biggest competitor in the PCIe switch space.) In these low competition markets, Broadcom raises prices and also puts heavy bundling burdens on hardware companies where supply or reasonable pricing are withheld.

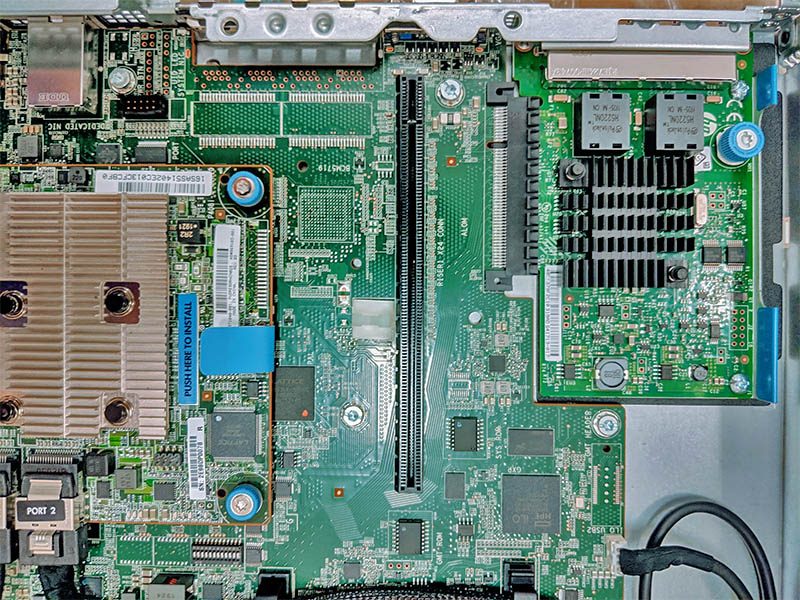

This is not just done to small server makers. A great example where we saw this to the detriment of customers we saw in our An Important HPE ProLiant DL325 Gen10 Change Since Our Review piece. Here in the top center of the photo, you can see the pads and silkscreen for the “BCM5719” 1GbE NIC. On the right, you can see an Intel i350-t4 add-in NIC. This may seem confusing.

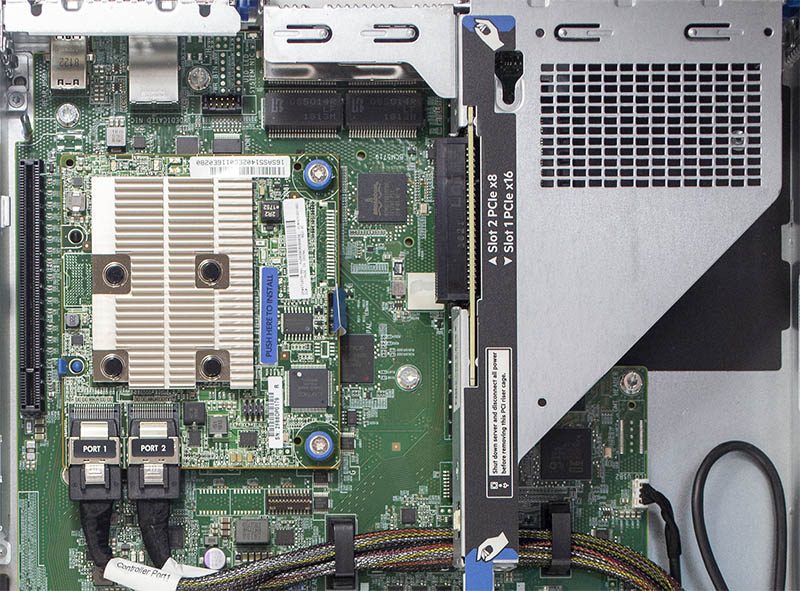

Here is the previous generation’s same area (but with the PCIe riser installed). Here you can see the NIC:

What happened to make HPE not place the designed-in Broadcom 1GbE controller is that Broadcom raised prices several fold on a fairly commoditized part for HPE servers. Quad-port 1GbE NICs are 4Gbps in an era where 200Gbps NICs were available making them the relatively low-value NICs in many servers. The value of these NICs is that Broadcom was designed into the ProLiant Gen10 line. HPE’s option at that point was to either capitulate and pay higher prices or do what we see in the above photo and move the NIC to an add-in card with an Intel controller. We strongly prefer the Intel i350 to Broadcom’s chips in this line, but that was not the point. Instead, the expansion slot had to be used for an additional add-in NIC and could not be used for higher-speed NICs. We had been deploying these servers with 40GbE dual-port NICs in this slot, and could not in this server because of the Broadcom move.

Not only was a massively increased pricing on a designed-in part an annoyance to HPE, and many of HPE’s customers, but it also meant another PCB had to be added to keep costs reasonable. Given the focus on environmental consciousness, adding another PCB is not what we would want to see. From rumors that we heard, keeping the Broadcom chip, given the pricing and HPE’s margins, would have likely meant a greater than $100 increase in price for the servers even the lower-end models that sell for $1000-$1300. This is on a relatively low-value chip. The Intel i350 at this time was in the mid-$20’s.

While this may seem like an isolated case, we have heard stories like PCIe switches getting 3x more expensive overnight post-PLX acquisition and to this day, server manufacturers often tell us about Broadcom’s heavy-handed business practices. These have happened beyond just PCIe switches and NICs and even with things like LSI controllers after that acquisition.

That is the company that is buying VMware. While we are discussing hardware lock-in due to being designed-in, VMware customers should be very cautious. Broadcom’s playbook is to push for higher pricing in its acquisitions and across its portfolio to customers that have little ability to switch, like with the NICs in the HPE server. Companies running VMware today have high switching costs, and so Broadcom likely knows that it can sell the same software and support for more without having many companies leave.

Final Words

For Michael Dell and many of those that will have a liquidity event with VMware’s purchase, this is a great day. For customers of VMware, it may be worth thinking about contingencies if prices rise. Increased pricing may be fine but from the server hardware industry perspective, VMware customers should expect this under new leadership. Get ready for a big change in the industry.

As a VMware Administrator for a small company this is scary. Overall I try to avoid Broadcom products whenever possible. However, I could see this being bad not just from a cost perspective but from a compatibility perspective. Once the acquisition is completed what is stopping Broadcom from not supporting other NIC chipsets in VMware. Much like switch vendors vendor-lock their switches so you need their SFPs, Broadcom could vendor-lock VMware to only support their NIC chipsets.

I for one just want to say I’m in agreement. I’m also lovin’ that STH makes a statement and then says “here’s PCB with the impact of Broadcom’s policies.” That’s what makes STH special.

> The merger agreement provides for a “go-shop” provision under which VMware and its Board of Directors may actively solicit, receive, evaluate and potentially enter negotiations with parties that offer alternative proposals during a 40-day period following the execution date of the definitive agreement, expiring at 11:59 p.m. Pacific Time on July 5, 2022

Unlikely that someone else would propose a higher offer however.

I just hope that this will push huge piles of capital towards Proxmox and make it even better than it is today! That may be one positive thing to come from this mess..

Rip VMware…

Broadcom are horrible after acquiring products, look at some of the Symantec line they trashed..

There is still a significant onprem VM presence out there and this will likely push people away onto cloud ecosystems or to open source virtualisation platforms

seen first hand the ‘support’ they gave symantec customers…..absolutely trashed the customer base. Makes you wonder about their long term plans on such a large investment by them when they lose all the customers that were using that product…..my guess is people will look to alternative vm solutions or accelerate from onprem to full cloud post this purchase…

Having firsthand experience at what Broadcom has done to prior products I liked (*cough* Symantec *cough*), the idea of them buying VMware is a huge disappointment. Their support is awful, their pricing even worse. I hate to say it but this feels like the beginning of the end for the company that changed data centers forever.

Hate to say it, I agree with Eric, the writing is on the wall. What a shame for the IT industry.

So it seems like Broadcom plans to ‘focus on rapid transition to subscriptions’ immediately after the acquisition. Just like always.

Well, good time to switch to proxmox unless you’re one of those person who subscribes to some sort of “build your meal” food delivery service…

Another good reason to move on to XCP-ng+Xen server which I have done for many years.

Those who stayed on even during the “multicore = multicost” saga are surely burying their heads in the sand waiting for the worse to happen.

With no new revolutionary technology, I think VMware was destined for stagnation. Broadcom’s strategy to focus on the largest 600 or so customers might be the worst outsome. This way, the largest users ought to be OK. It would be hardest for them to switch, but there are legit alternatives. There’s Hyper-V and OVM/Citrix/RHEV and supported KVM from Oracle & IBM, etc. There ought to be capacity to threaten to switch.

Aside from other hypervisors, AWS/MS/GCP/OCI/IBM offer supported ESXi hosting. They can deal with Broadcom and offer a destination for VMware workloads to smaller customers. The clouds gain support efficiencies from standardization.

VMware users too small for Broadcom to care about and who don’t want to (or can’t) go to hosted options remain the losers. As VMware revenue plateaus, though, they probably felt they needed a better plan than “earn similar margins on soon-to-be-shrinking revenue.”

craps, I meant Broadcom’s plan might NOT be the worst outcome